Inflation is vicious to fiat money users

by tonytran2015 (Melbourne, Australia).

Click here for a full, up to date ORIGINAL ARTICLE and to help fighting the stealing of readers’ traffic.

(Blog No.57).

#inflation, #fiat money, #taxation by stealth, #indexation, #cost of living

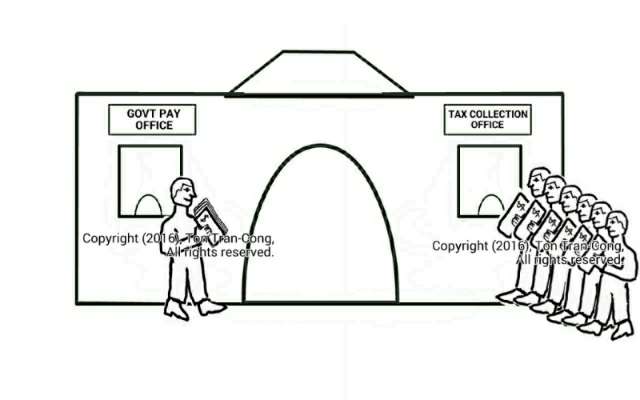

Figure 1: Fiat money are paid to government employees. All citizens have to pay their taxes with that fiat money.

Inflation is vicious to the citizens who have to accept fiat currency from their ruling government. It is half terrible as having to use money with some use-by dates. Only governments like inflation.

1. Inflation.

It is convenient to begin the discussion with my previous posting entitled Your Fiat Money, part 2 (reference [1]). It is easily seen that the government can choose to pay its employees X units of its fiat currency C1 and require the whole population to pay it all taxes amounting to X units of that currency. The fiat money C1 will find its own value in the population depending on how government employees interact with the whole population of the country.

Alternatively, the government can choose to pay its employees Y units of another fiat currency C2 and require the whole population to pay it all taxes amounting to Y units of currency C2. Again the fiat money will find its own value in the population.

As other things are equal, we must have

X*C1 = Y*C2

and the value of a fiat currency is inversely proportional to the amount issued by the government to its employees.

Consequently, if all other things are unchanged but the government increases both the payment to its employees and the tax to be collected by 3% every year then its currency is worth only 100/(100+3) its former value one year ago. This is called an inflation at a rate of 3% per year.

2. Inflation is a rent on fiat money.

After selling his stock, a trader has cash (which is fiat money), he will have to use his cash to buy new stock. If he holds on with the cash for one year, he can buy only (100-3)% of what he could have bought immediately. This works as if he was renting the cash from the government at a cost of 3% a year.

The long standing wisdom is not renting anything you don’t really need and people should not keep cash longer than it is absolute necessery.

Any government will love inflation. It is its best next thing to issueing money with expiry dates and un-redeemable government bonds, vouchers (Old scams but still can be practiced against illiterate, trusting populations)

3. High inflation may feed on itself.

Remember that the fiat money will find its own value in the population depending on how government employees interact with the whole population of the country.

When high inflation occurs people may try to increases prices in anticipation, causing even more severe inflation.

People may then even try to avoid using any fiat money at all and they may choose their own alternative bartering medium such as food (rice grains or flour) or commodities (gold or silver) instead of the readily available but steadily depreciating fiat money.(see [4,5,6,7] for bartering techniques). Such avoidance of fiat money brings even more loss of its value and deepens the inflation.

When inflation is too high, the ruling government may lose its grips on the economy and chaos may follow (as in Germany prior to 1933).

4. High inflation reduces actual interests on government debentures/treasury bonds.

Inflation is to be subtracted from the interest rate given by any government debenture/treasury bond.

The inflation rate is hard to obtain but it must be taken into account when buying government debentures.

Unless the after tax return from a government debenture/treasury bond is higher than inflation, the bond holders may actually LOSE money on their bonds.

The interest rate given on Government Debenture/Treasury Bond is determined at the time of sale while actual inflation is made after that time. A government can easily wipe out its debts to bond holders by producing very high inflation. (see [10]).

5. Inflation rips off members of pension plans.

The loss caused by inflation on cash based holdings (rents on cash) also applies to long term storage of values such as saving for retirements.

Unless inflation has been taken into account, most perceived benefits of pension plans can be only just mirages given to uninformed plan members. To have any real benefit after tax and INFLATION, plan members usually need cash contributions/injections by the government and if they don’t obtain them there will arise the problem of unfunded liabilities.

In most cases, the contributed funds of any pension plan cannot earn any net income AFTER tax and INFLATION. If there is no cash contribution/injection by government, plan members would be MUCH better off using their contributions to buy gold and save the gold for their own retirements.

Figure: Vietnamese standardized gold slabs for trading.

The imminent run (insolvency) of pension plans are only the tip of the iceberg.(see reference [8]).

6. Inflation produces a stealthy wealth tax.

Inflation actually produces stealthy, disguised taxes on your properties.

When you change your house, as you have to move to a new location for new jobs, the value of that succession of similar houses keep on increasing due to inflation. Governments can classify the increases as “incomes” and impose taxes on them. Some governments have already done that. This type of FALSE incomes may also be extended to include your other possessions such as cars, jewelleries, housegold goods and gold holding.

These taxes on FALSE incomes are actually taxes on your possessions such as your houses and the tax rate depends on inflation. Your legislative representatives will not bother to make yearly oversight of it and the governments easily get away with it.

The federal authority may have encroached on the rights of member states if it makes property taxes! So the federal authority has to do it under the guise of income tax on false incomes produced by inflation.

Note added on 15 May 2017:

Only recently, the US State of Arizona admitted that gain/loss made from gold holding is not subjected to Income Tax of that State.[11]

7. Inflation causes non-synchronized price increases.

Inflation causes uneven, non-synchronized price increases due to different flow on times for different types of goods. This allows the government to put unfair short term weighting factors on individual types of consumer goods. The weighting factors let the government artificially select them to manipulate the yearly statistics on the Cost of living to lessen its obligation to pay pensioners their entitled upkeep.

8. Inflation forces people to borrow.

Inflation forces people to borrow with any purchase plan stretching over many years. A buyer would lose to inflation on his cash accumulation/saving if he wants to remain debt free and save up the whole amount for the purchase. House purchases are typical examples where buyers are forced to borrow.

9. Inflation gives government unfair advantages in charging taxes on citizens.

When you made a huge loss and claimed a carried forward loss to offset against possible future gain in calculating income tax, the loss is NOT indexed by inflation! So a loss of $1000 by a future trader in 2010 can only offset against a gain of $1000 in 2017! (Although $1000 in 2017 is worth much less than in 2010)

10. All governments love inflation.

A government loves inflation for the following reasons:

1. Inflation is a rent on its fiat money.

2. It can define False incomes and tax its citizens on the false incomes.

3. It can muddle statistics on Cost of living and the government can fool the world with its manipulated figures on the growths in GDP, GNI.

4. It allows government to gain unfair advantages over its tax payers when calculating their taxable incomes.

So the claims that Inflation is preferred to deflation by governments should be read with skepticism. Unfortunately, the statement has been told often enough and for long enough so that a number of tax payers have started to believe in it without questioning. (A lie told once remains a lie but a lie told a thousand times becomes the truth, by J. Goebbels [9].)

References:

[1]. Your fiat money (Part 2), posted January 12, 2017.

[2]. Your fiat money, posted January 9, 2017.

[3]. Why does the Federal Reserve aim for 2 percent inflation over time?, Board of Governors of the Federal Reserve System,https://www.federalreserve.gov/faqs/economy_14400.htm, updated January 26, 2015, accessed 03 Mar 2017.

[4]. Neha Sharma and Shalu Yadav, The Indian village that has returned to bartering, BBC News Services,http://www.bbc.com/news/world-asia-india-38180075, 5 December 2016.

[5]. Patrick Bodenham, Will Spain’s coal belt survive through online barter?, BBC News Services,http://www.bbc.com/news/world-europe-38731808, 2 February 2017.

[6]. James Melik, Haggling and bartering gain appeal, BBC News Services,http://news.bbc.co.uk/2/hi/business/7883050.stm, 12 February 2009.

[7]. Mark Lowen, Greece bartering system popular in Volos, BBC News Services,http://www.bbc.com/news/world-europe-17680904, 12 April 2012.

[8]. Dallas police fire pension board ends run, bank stops 154m withdrawals. http://www.dallasnews.com/news/dallas-city-hall/2016/12/08/dallas-police-fire-pension-board-ends-run-bank-stops-154m-withdrawals

[9]. Joseph Goebbels quotes, azquotes.com, http://www.azquotes.com/author/5626-Joseph_Goebbels.

[10]. https://www.moneymetals.com/news/2017/05/04/higher-inflation-consumer-prices-001061, (added on 10 May 2017).

[11]. http://www.zerohedge.com/news/2017-05-13/arizona-passes-bill-end-income-taxation-gold-and-silver

References added after 2017 November:

[12]. http://www.gold-eagle.com/article/deepening-crisis-hyper-inflationary-venezuela-and-zimbabwe

[13]. https://us-issues.com/2017/11/21/social-security-inflation-lag-calendar-partial-indexing/

[15]. https://mises.org/wire/dollar-dilemma-where-here

[16]. https://straightlinelogic.com/2018/08/04/how-inflation-destroys-civilization-by-nick-giambruno/

Added after 2018 Aug 15th:

[17]. https://www.silver-phoenix500.com/article/anatomy-hyperinflation

[18]. https://us-issues.com/2018/08/19/anatomy-of-hyperinflation/

[21]. https://yapaholic.com/2018/08/19/us-national-debt-heres-what-you-need-to-know/

[22]. https://www.caseyresearch.com/how-inflation-destroys-civilization/

[23]. How Venezuela’s crisis developed and drove out millions of people, https://www.bbc.com/news/world-latin-america-36319877

RELATED MONEY Blogs

QE may be just another scam to steal national wealth,

Inflation is vicious to fiat money users

Bankers earn more than interest margin on secured loans, posted on December 15 2016,

Bankers given outrageous incomes by their boards, posted on December 22 2016,

RELATED MONEY Blogs

Click here for my other blogs on  SURVIVAL

SURVIVAL

Click here to go to Home Page (Navigation-Survival-How To-Money).

Home Page (Navigation-Survival-How To-Money).

BLOG IMAGE OF CONTENTS HOME PAGE

[…] Inflation is vicious to fiat money users) […]

LikeLiked by 1 person

[…] 2: Shifty Lenders, The Parasites of Western Economy-Part 1: Motorvehicle Insurance Scammers, Inflation is vicious to fiat money users, QE may be just another scam to steal national wealth, Cashless bartering for survival, Federal […]

LikeLike

[…] Source: Inflation is vicious to fiat money users. […]

LikeLike

Thank you, VikingLifeBlog, for re-blogging

LikeLike