by tonytran2015 (Melbourne, Australia).

Click here for a full, up to date ORIGINAL ARTICLE and to help fighting the stealing of readers’ traffic.

(Blog No.47).

1. Fiat money

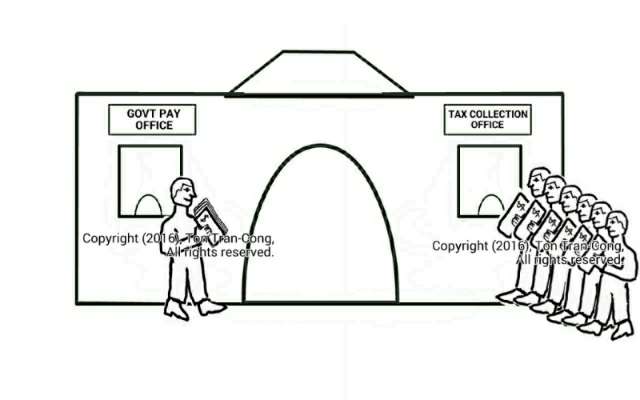

Figure 1: Fiat money are paid to government employees. All citizens have to pay their taxes with that fiat money.

The simple basis for accepting the fiat money is that those who had done works for the government have the fiat money (a form of certificates) and the population at large have to exchange goods and service for those certificates to pay their own tax (those who don’t pay will be jailed) and buy some goods or service from the government.

2. Pushing for public use of the fiat money as a storage for wealth.

A government will require that its people pay their taxes and government service fees with its fiat money. They must do it or face having no government service or even face punishment.

People in that country have to obtain the money from government employees (who have been paid with fiat money) by supplying them with goods or service.

So the government has created a demand for its fiat money at the time of tax payment.

It is clear that a fiat money requires neither trust in nor support for the government nor any gold or silver holding by the government.

As long as the fiat money has NO EXPIRY DATES, the population at large may prefer keeping it even outside tax time to keeping perishable goods as a form of storing their “wealth” for rainy days.

This second step of using fiat money to store “wealth” relies (rightly or wrongly) on the belief that the government will not suddenly declare those certificates invalid (demonetize some denominations).

The pre-WW2, National Socialist (1933) government of Germany is most known for operating its economy with neither gold nor foreign currency backing using only its own fiat money called Reich Marchs.

The coupon system in communist countries is also similar to fiat currency with the difference that coupons are not freely transferable and may have expiry dates.

3. Fiat money sets its own value against goods and service.

If all government employees are self-sufficient homesteaders spending little money then the fiat money exchanges itself with a lot of goods or service from other people who need them to pay taxes. The population at large has to compete hard for fiat money in order to pay their tax!

If all government employees are like drunken sailors spending money easily then the fiat money exchanges itself with little goods or service (and the drunken sailors may then complain that they had not been paid much !) .

It all follows the rule of Supply and Demand between government employees and the population at large.

4. A government can influence the value of its fiat money.

A government can lower the value of its fiat money by reducing its tax while keeping the payment to its employees unchanged. It can also do that by offering to buy some type of goods from its citizens for government usage or government storage .

Conversely, the government can increase the value of its fiat money by increasing its tax while keeping the payment to its employees unchanged. It can also do that by selling to its citizens goods in government stores (including foreign currency) or rights to use some government resource.

However, when its tax is too high, a government risks causing a revolt by its people (as the British empire had bitterly found out with its taxes on its American colony). On the other hand, if tax is too low relative to government payments, there is a risk of high inflation and the population may try to avoid fiat money until tax time, when they absolutely need it for paying their taxes.

5. Keeping the value of fiat money constant.

It is easy to see that for an unchanged population and an unchanged economy, the fiat money has a constant value when government’s yearly payment is equal to its collected tax.

If the government’s collected tax is more than its payout (having a budget surplus) it will sit on a stack of its own fiat money. In this case, it can even use its own fiat money to buy gold from the population at large.

If the government’s collected tax is less than its payout (having a budget deficit) it will need to draw from the stack of fiat money it has saved up from previous years or it may even have to sell its gold reserve to the people to get back some of its own fiat money to make up for the short fall for spending.

So the gold reserve is just a buffer to cover for years of low tax collection.

6. The gold reserve of a country does not need to be of any fix ratio to the total of fiat money in circulation.

The gold reserve only determines the total of all consecutive budget deficits before the government run out of gold to sell to the people to uphold the value of its fiat money. (See references [4], [5] for the removal of gold backing to the dollars.)

Any government with good record of never having budget deficit does not need any gold reserve . However, some gold reserve is always kept as a precaution against multiple years of natural disasters. It is noted that a number of countries deposit their gold reserves overseas despite the risk of losing them to the keeper countries (see reference [6], [7]).

A government with reckless overspending will have to sell its gold and rights to use national resources until the day it has nothing left to sell. Then the value of its fiat money may plunge.

Leaving aside the question of whether its gold was undersold or not (see reference [8]), the British government might be right in selling its gold reserve in the 1990’s if it can be absolutely certain to always have NO budget deficit from that time, even in the face of natural disasters.

7. Borrowing from the population.

When the government want to borrow X units of its fiat money from its citizens, it may have to conduct an “auction” of one of the following two types:

a. It may offer to all of its people to give the government any each of their spare $900 now to receive $1000 in 1 year time.

Too many of its citizens may accept the offer and the total amount of their money may far exceed the requirement of the government. If that is the case, it may next say No, not $900 anymore, but $910. The amount may goes up again until the acceptance has only about X units, the amount it requires.

Anti-corruption requires that the bidding process be public and transparent.

This is the idea of Treasury Bills, see [9].

If the final auction price is $970 of current money for $1000 of money in 1 year time then the Treasury Bill rate is (1000-970)/970 or 3.1%.

b. It may offer to all of its people to give the government any each of their spare $1000 now to receive a (transferable, resellable) certificate to receive $30 every year and hold it until the end of 10th year to get $30 plus the principal of $1000.

Too many of its citizens may accept the offer and the total amount of their money may far exceed the requirement of the government. If that is the case, it may next say No, not $30/year anymore, but $20/year. The amount may goes up again until the acceptance has only about X units, the amount it requires.

This is the idea of Treasury Notes, Treasury Bonds.

8. The foreign exchange value and the bond rate of a fiat currency in a growing economy.

When the economy goes strongly, there is anticipation of budget surplus and government developing more growth or adding to its gold reserve and there is more confidence in its fiat currency. Its fiat currency is in strong demand by its neighbors to buy its goods and service, hence its exchange rate may rise.

At the same time, its people feel good and want to use their existing money to set up shops or factories. The Treasury Notes auction offers are now less attractive and there would be fewer participants therefore its Bond rate rises.

The converse applies to a weakening economy.

References

[1] . tonytran2015, your fiat money, https://survivaltricks.wordpress.com/2017/01/09/your-fiat-money/, posted on Jan 9, 2017

[2]. Demonetizing in India robs the poor, posted on December 1, 2016

[3]. Venezuela follows Indias footsteps in demonetization scheme, econotimes.com, http://www.econotimes.com/Venezuela-follows-Indias-footsteps-in-demonetization-scheme-445257

[4]. FDR takes United States off gold standard (1933), history.com, http://www.history.com/this-day-in-history/fdr-takes-united-states-off-gold-standard, accessed 10 Feb 2017

[5]. Nixon shock, Wikipedia, https://en.wikipedia.org/wiki/Nixon_shock, accessed 10 Feb 2017

[6]. De Gaulle and international monetary relations, charles-de-gaulle.com, http://www.charles-de-gaulle.com/the-stateman/the-modernisation-of-the-country/de-gaulle-and-international-monetary-relations.html, access 10 Feb 2017.

[7]. Germany brings its gold stash home sooner than planned, cnbc news,

http://www.charles-de-gaulle.com/the-stateman/the-modernisation-of-the-country/de-gaulle-and-international-monetary-relations.html, 10 Feb 2017.

[8]. Sale of UK gold reserves, 1999–2002, Wikipedia, https://en.wikipedia.org/wiki/Sale_of_UK_gold_reserves,_1999-2002, accessed 10 Feb 2017.

[9]. https://www.treasurydirect.gov/

Added after 2018 Feb 04:

[10]. http://www.gold-eagle.com/article/last-fed-chairman

[11]. https://venitism.wordpress.com/2018/02/23/quantitative-economics/

[13]. https://us-issues.com/2018/08/12/price-of-gold-in-venezuela/

Australian debts and treasury bonds.

[14]. https://www.abc.net.au/news/2014-06-12/joe-hockey-one-billion-a-month-interest-fact-check/5478480

Alan Greenspan: “Central banks can issue currency, a non-interest-bearing claim on the government, effectively without limit. A government cannot become insolvent with respect to obligations in its own currency.”

St. Louis Federal Reserve: “As the sole manufacturer of dollars, whose debt is denominated in dollars, the U.S. government can never become insolvent, i.e.,unable to pay its bills. In this sense, the government is not dependent on credit markets to remain operational.

[15]. https://mythfighter.com/2018/11/14/the-debt-lies-just-keep-on-coming/

[16]. https://counterinformation.wordpress.com/2019/09/12/argentina-returns-to-capital-controls/

[17]. How Hitler Defied The Bankers (https://survivaltricks.wordpress.com/2019/07/13/how-hitler-defied-the-bankers/)

RELATED MONEY Blogs

QE may be just another scam to steal national wealth,

Inflation is vicious to fiat money users

Bankers earn more than interest margin on secured loans, posted on December 15 2016,

Bankers given outrageous incomes by their boards, posted on December 22 2016,

Gold for storing wealth, posted on 28 April 2017

Click here for my other blogs on  MONEY

MONEY

Click here go to  Home Page (Navigation-Survival-How To-Money).

Home Page (Navigation-Survival-How To-Money).

BLOG IMAGE OF CONTENTS HOME PAGE

“I really liked your article post.Really thank you! Will read on…”

LikeLike

[…] fees to Americans., A satirical guide to signs of an impending crash for small investors, Your fiat money (Part 2), Your fiat money, Bankers given outrageous incomes by their boards, Signs pointing to an impending […]

LikeLike

After going over a number of the blog posts on your web page, I really like your technique of writing a blog. I added it to my bookmark webpage list and will be checking back in the near future. Please visit my web site as well and let me know your opinion.|

LikeLike

Pretty! This has been a really wonderful article. Many thanks for providing these details.|

LikeLike

After going over a few of the articles on your blog, I truly like your way of blogging. I saved as a favorite it to my bookmark website list and will be checking back soon. Take a look at my website as well and tell me how you feel.|

LikeLike

Hi colleagues, good post and good arguments commented here, I am really enjoying by these.|

LikeLike

Hi there, just wanted to mention, I liked this article. It was helpful. Keep on posting!|

LikeLike

Heya i am for the first time here. I came across this board and I find It truly useful & it helped me out a lot. I hope to give something back and aid others like you helped me.|

LikeLike

I do consider all the concepts you’ve introduced to your post. They are really convincing and will certainly work. Nonetheless, the posts are very quick for novices. Could you please extend them a little from subsequent time? Thank you for the post.|

LikeLike

Nice post. I learn something new and challenging on websites I stumbleupon everyday. It’s always exciting to read content from other writers and practice a little something from other sites. |

LikeLike

It’s very trouble-free to find out any topic on net as compared to books, as I found this piece of writing at this site.|

LikeLike

Good article. I absolutely appreciate this website. Thanks!|

LikeLike

Thanks for sharing your thoughts about meta_keyword. Regards|

LikeLike

My developer is trying to persuade me to move to .net from PHP. I have always disliked the idea because of the expenses. But he’s tryiong none the less. I’ve been using WordPress on a variety of websites for about a year and am concerned about switching to another platform. I have heard fantastic things about blogengine.net. Is there a way I can import all my wordpress content into it? Any kind of help would be really appreciated!|

LikeLike

Wow, that’s what I was seeking for, what a information! existing here at this blog, thanks admin of this website.|

LikeLike

Interesting! I have made a post, with link to part 1 & 2!

LikeLike

Thank you, Vikinglifeblog, for re-blogging.

LikeLiked by 1 person

[…] https://survivaltricks.wordpress.com/2017/01/12/your-fiat-money-part-2/ […]

LikeLike